reps and warranties insurance market

Representations and Warranties RW Insurance. Until this year illustrating the market for representations and warranties RW insurance has been akin to hitting a moving target.

Reps And Warranties Insurance 2022 First Quarter Round Up Woodruff Sawyer Jdsupra

We offer 25 million - 35 million in capacity and can lead or participate in larger programs.

. This shows us those MA practitioners who use RWI continue using the product in the face of temporary higher pricing and tighter terms. A representation is a statement of fact. 75 of all PE transactions have RW insurance.

Senior Vice President National Group Leader - MA Insurance. There has been continued growth of the product and while there were slight changes. Standard policy terms are three years for general reps and 6 years for fundamental reps.

5 Standard Policy Terms. In such structure the representations and warranties in the agreement will not survive the closing and the sellers have no indemnity liability for any breach. If a representation is untrue.

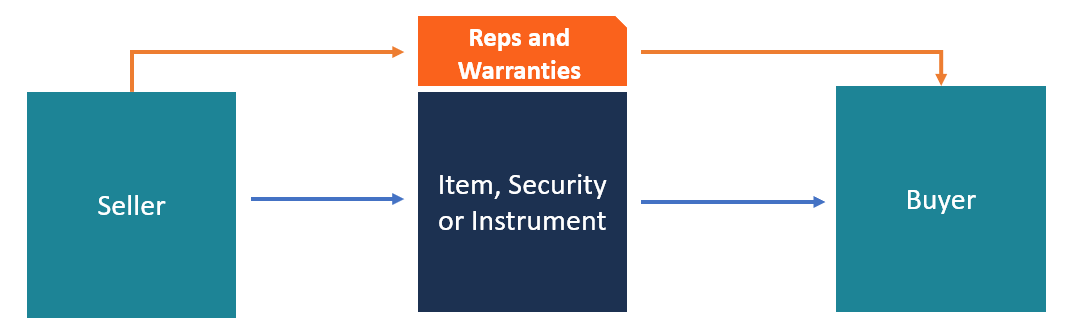

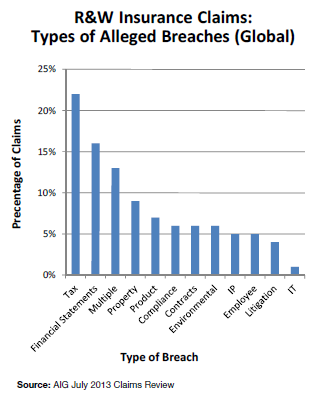

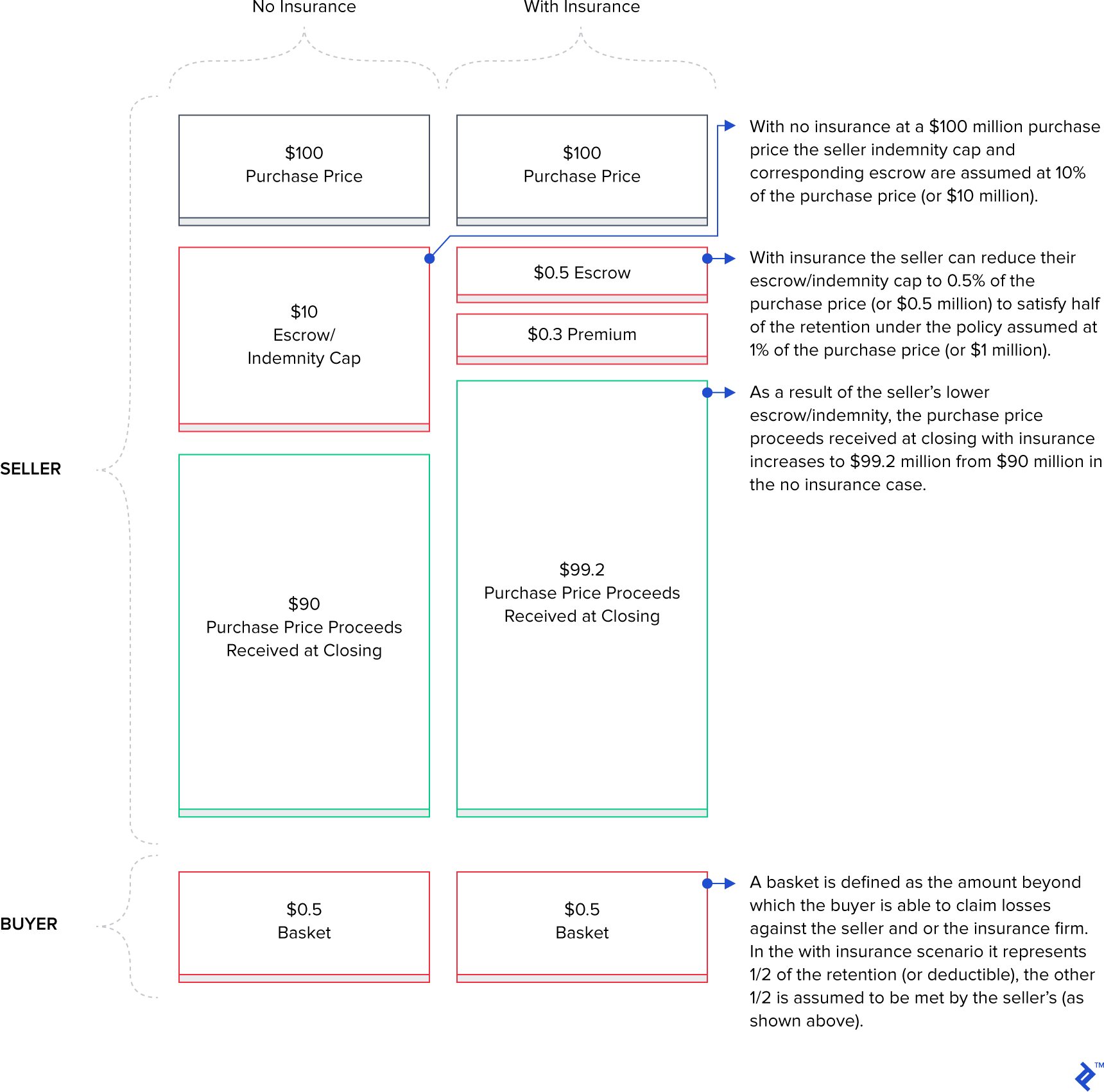

Available for both buyers and sellers in a transaction representations and warranties insurance provides protection against financial losses ¹ including costs associated with defending claims for certain unintentional and unknown breaches of the sellers representations and warranties made. The cost of rep and warranty insurance is between 1 and 15 of the amount of insurance sought which can be negotiable. In other words the buyer bears the full.

2020 Market Conditions Report. According to a recent study in 2018 to 2019 52 of private company transaction agreements referred to RWI up from only 29 in 2016 to 2017. In 2019 we began to experience a normalization of the market.

From 2008 to 2018 the total RW policies bound per year in North America rose from 40 deals providing 541 million of coverage to 1500 RW insurance transactions providing aggregate coverage of 386. With the overall MA market on a roll players such as private equity companies and others have increasingly opted to use the coverage to facilitate deals. 10 PointsReps Warranties Insurance Wednesday September 4 2019 Use of Representations and Warranties Insurance RWI has exploded within middlemarket MA during the current economic cycle.

The percentage of transactions expressly referencing RWI increased from 29 in the 2017 study to 52 in the 2019 study. Over the last decade the use of RW insurance in merger and acquisition transactions has grown exponentially. The question is why.

Representation Warranty US. Just as the deal market has remained strong for several years and healthy valuations persist the market for representations and warranties insurance has expanded rapidly. The most recent two of these studies 2017 and 2019 have looked at representation and warranty insurance RWI in private company merger and acquisition MA transactions.

Leading Woodruff Sawyers MA practice Emily provides consultation to clients. More recent information sets the target at 50 million to 2 billion. This includes Representations and Warranties Tax Opinion Liability and Litigation Buy-Out coverages.

The standard coverage amount is 10 of the purchase price. When Rep and Warranties Insurance is used in a deal the insurance company steps into the place of the seller to fund those indemnification requirements. 50-60 of all mid-market MA transactions have RW insurance.

In the middle market about half of the private deals done are backed by Reps and Warranties Insurance also known as RW Insurance. Please refer to the section above Cost Of Rep And Warranty Insurance. Reps Warranties insurance protects against loss arising from a breach of a partys representations and warranties made in a merger or acquisition.

It also implies that the MA market remains robust. During sales processes it is common for the seller to provide warranties to the buyer on a broad range of matters about the target such as title to shares property employment tax intellectual property and other commercial matters. Participants in mergers and acquisitions MA are also increasingly using representations and warranties RW insurance or reps and warranties.

They can relate to the past present or future and are included as one of several critical clauses in a purchase agreement. The insurance company often relies on the buyers due diligence. Reps short for representations and warranties are statements of facts regarding a companys business assets liabilities and operations.

While lower-middle-market deal participants are still able to find RW insurance it is often coming at a higher premium than a year ago closer to 5 percent of the policy limit instead of the 2-4 percent range typically quoted by insurers. Join us at the Mohegan Sun Convention Center Hotel in Uncasville CT on May 3 4 2022 for the day and a half high-impact 6th Annual Reps Warranties Transactional Liability Insurance ExecuSummit ExecuSummit producers are in the forefront of the Reps Warranties Transactional Liability Insurance industry monitoring researching emerging issues and. RW protects buyers from future liabilities that can emerge from a company they have purchased.

Over the last decade the use of RW insurance in merger and acquisition transactions has grown exponentially. Goodwin has seen an increase in deals using RWI as the buyers sole remedy particularly in transactions with deal values in excess of 200M. From 2008 to 2018 the total RW policies bound per year in North America rose from 40 deals providing 541 million of coverage to 1500 RW insurance transactions providing aggregate coverage of 386 billion.

Many private equity firms require reps warranty insurance RW insurance. Editor Mergers Acquisitions. 1 Yet despite its dramatic growth in the private company deal market RWI has so far been almost entirely absent from public MA transactions public company deals in the US.

In a traditional MA transaction the seller or its shareholders agree to indemnify the buyer subject to caps exclusions and time limits. The insured may be either the seller or the buyer. For example if 10000000 in insurance protection is sought then the rep and warranty insurance premium will be around 100000-150000.

The health care industry where transactions have ballooned in recent years has lately caught.

What Is Rep And Warranty Insurance

Reps And Warranties Insurance Vanbridge

Reps And Warranties Insurance Market Update Volatility And Trends Woodruff Sawyer Jdsupra

Reps And Warranties Insurance 2022 First Quarter Round Up Woodruff Sawyer Jdsupra

M A Insurance Providing Dealmakers An Edge In A Crowded M A Market

What Is Representations And Warranties Insurance Rob Freeman

Reps And Warranties Overview Benefits And Challenges

2020 Market Conditions Report Representations Warranties Gallagher Usa

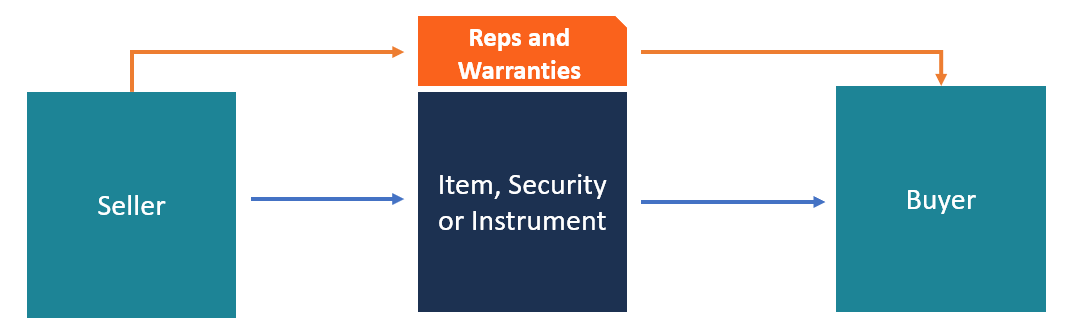

Representations And Warranties Insurance Claim Study Aon

Multiple Based Damage Claims Under Representation Warranty Insurance

Us M A Boom Is Overheating The Reps And Warranties Market

Reps Warranty Insurance Colonnade Advisors

Reps Warranties Insurance Market Update Q3 2020 Woodruff Sawyer

Reps And Warranties Insurance Market Update Volatility And Trends Woodruff Sawyer Jdsupra

The Value Of Reps Warranties Insurance A Comprehensive Review Going Into 2019 Risk Insurance

The Reps Warranties Market Adapts To Covid 19 Middle Market Growth

M A Insurance Providing Dealmakers An Edge In A Crowded M A Market

Intro To Reps And Warranties Insurance Toptal

0 Response to "reps and warranties insurance market"

Post a Comment